My Rating – Must Have

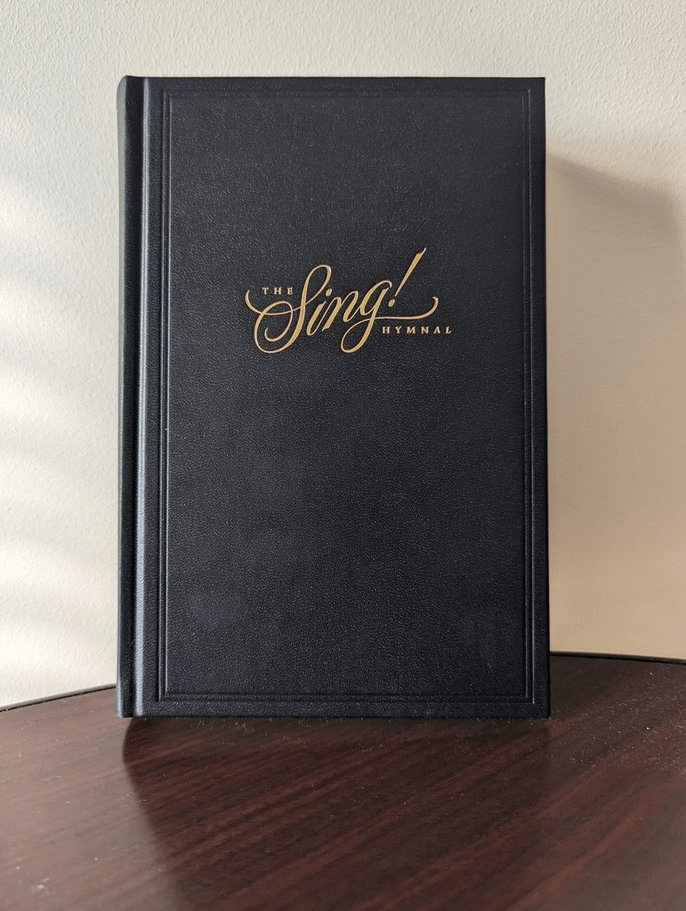

Level – I’ve never reviewed a hymnal before, not sure how to gauge this versus others. If you’ve used a hymnal before, this is pretty much standard. I suppose if you never have, it could be confusing. If you’ve never used a hymnal before and/or find them confusing, let me know in the comments, I’d love to hear about it. Lengthwise, this appears to be a little longer than standard. I’m not sure if that is due to the extra writings or if it has more songs than average as well.

Summary

If you haven’t used a hymnal in a long time, or ever, they aren’t arraigned alphabetically, which would be nice for the congregant. They are arranged in groups, usually topical or seasonal, depending. The Sing! Hymnal has songs arranged in three larger conceptual groupings, with specific subgroups: The Worship Service which includes – Call to Worship, Adoration, God the Creator, The Providence of God, Confession & Lament, Assurance of Salvation, God’s Grace in Salvation, The Person of Christ, the Work of Christ, Prayer, Offertory, Illumination & the Word of God, Communion, Doxology & Benediction; The Christian Life – Hymns for Little Children, Conversion & Faith, Discipleship & Consecration, The Church, Evangelism & Missions, Psalms, Suffer, Comfort & Hope, Thanksgiving, Death & Eternity; and The Life of Christ – Advent, Christmas, Epiphany, Palm Sunday & Holy Week, Easter, Ascension, Pentecost, the Return of Christ.

There are also intros, a forward, etc. as well as over 1,000 pages of different indexes, postlude, and short intro/history to a number of hymns.

My Thoughts

This is the first time I’ve reviewed a hymnal so bear with me. Mrs. MMT is a worship leader that puts services and retreat together, and we have four other hymnals at our house – a United Methodist, Southern Baptist, Presbyterian, and another I’m not really sure, either some kind of independent Baptist commission or maybe Cooperative Baptist Fellowship (which was the convention that church we attended belonged to). Interestingly, that one had the newest publication date at 1993, all others were older. So, that kind of gives you an idea of how new publishing in 2025 is. I’m sure there have been some others here and there, but I’m not aware of any publisher as large or influential as Crossway putting one out. In fact, it is almost always denominations printing their own. There are so man independent or loosely affiliated churches out there, that it is probably a good thing there is a non-denominational hymnal out there. I think (hope) it is also part of the growing trend of a little more cohesion, liturgy, and standardization coming back to churches after decades of pushing those away.

As I mentioned earlier, the arraignments aren’t alphabetical, as they are published to help the worship leader or music minister set up the service. It can always be a risk that without some sort of guide or anchor, someone could just pick whatever they want or feel like, or pick songs that are ‘fun to play’ (don’t @ me, I know that have a hymnal doesn’t stop them either). I think it can also be a good reminder that there are 100’s a great songs from which to choose, not just the 12 on the radio right now. Along those lines, we can sing some during particular seasons or parts of the year and then switch to others other times, instead of the same song six weeks in a row.

What is interesting about Sing, is they chose older hymns, those we typically think of has ‘hymns’, as well as newer songs or others written in the last 50 years or so. The choices seem to be outstanding. I appreciate them keeping a number of well known or traditional songs, as well as digging through the new ones and making sure to pull in those with with depth, theology, and quality that will likely keep them around for hundreds of years. There area also scriptures, prayers, benedictions, psalms, and writings scattered throughout the book, but laid out in those sections where they would fit best. For instance a psalm near the call to worship songs, or prayer in advent, or scripture with on of the songs of Comfort & Hope. That appears to be something different, or in addition when compared to other hymnals.

You kind of forget how much info is in hymnals in general. Our UMC copy has writings and liturgies from Wesley, and the PCA one has the Westminster Standards. I really hope this catches on and is used often in churches everywhere. However, it is also a great resource for family worship, or if you want to do other events like a worship night, or an advent group at your house (as we like to do).

A few quick criticisms, and then I’ll wrap up. First, personally, I don’t like using exclamation marks, so having one in the title irrationally bothers me. This is very minor, but 497 hymns? They couldn’t just toss in three more children or Christmas songs? I will say, arraigning the songs by groups can be difficult, because if you are thinking in terms of categories, you may see a song differently than the publishers. I picked three random hymns – It is Well, Be Thou My Vision, and Come Thou Fount and looked them up to see their category. The first is in Death & Eternity, which I guess I can see, but that is not where I would have checked first. The next was in Discipleship & Consecration, that is pretty straight forward. The final one is in the Call to Worship, which I just don’t understand. That might have been one of the last places I would’ve looked. That being said, there is an alphabetical index, somewhat confusing titled ‘Titles & First Lines’ that is the last index in the book. There is another index that is alphabetical called Hymn Tunes, which is earlier in the indexes, but that is just about the music.

Other than a few minor thoughts, I don’t see any issues with this book. Everything about it seems great, including the quality of the material and printing. It is a solid hardcover, nicely and simply designed, with thick, quality paper meant to hold up for a long time of use. The arraignment, layout, type/font, etc. all look wonderful as well. This is a must have for churches, and I’d encourage worship leaders or families and communities groups to consider getting it as well. You can check out their dedicated site for more info – https://www.singhymnal.com/

* I received a free copy of this book in exchange for an honest review.